Saving for retirement can feel like a full-time job. There’s budgeting, investing, and calculating how much you’ll need to live on after leaving the workforce. When you throw life insurance into the mix, your plan can get a little confusing. Cash value life insurance can help you take the worry out of

retirement planning

by acting as a personal savings plan from within your life insurance policy.

How does cash value insurance work?

Not to be confused with a cash-back or

return of premium rider

, cash value insurance is a type of whole life or

universal life insurance

that lasts as long as you’re alive and premiums are paid.

Each month, an amount of your premium goes towards a savings account within your policy, and that cash value grows tax-deferred over the life of the policy.

Cash value is tied to whole life + universal life insurance

Cash value insurance is different from other life insurance options like term life insurance, which only provides coverage for a set period (usually 10, 20 or 30 years). You can’t cash out your term life policy, so your family would only receive a benefit if you pass away while the policy is in force. However, term life is more affordable and can be a good fit for younger people, families, and small business owners.

>>> Interested in term life insurance? Read more about it

here

.

Who needs cash value insurance?

If you have more complex financial needs, a policy with a cash value could be a worthwhile investment. For instance, if you’ve maxed out your retirement accounts, such as IRAs and 401(k)s, then a cash value policy could be an additional method for planning for retirement and saving money, tax-free.

Further, if you’re hoping to save towards an inheritance for your children, the tax-free benefit of a cash value policy could be ideal. If you have children with special needs who might need lifelong support, then a cash value option on your whole life insurance policy would be a smart way to save money.

Cash value offers cash savings + life insurance protection

With cash value insurance, your loved ones would still receive a

death benefit

when you die, even if you borrowed from the cash value while you were alive. Cash value in your policy exists in addition to your payout, but keep in mind that the total amount of your death benefit can be diminished if you withdraw money from the account while you’re alive.

As your policy matures, your options for using its cash value do as well

So, you want to withdraw money from the cash value of your life insurance policy? There are a few different ways you can use these funds, but using your cash value comes with a few risks, so it’s important to know the pros and cons before you dip into your account.

Withdraw money from the cash value

You can make

partial withdrawals from a cash value

account, just keep in mind that withdrawing money will affect the amount of the death benefit. Additionally, most policies only allow withdrawals to take place after the cash value savings has been able to grow for over a year. The amount you can take out (and the time frame in which you can withdraw money) depends on the terms of your specific insurance policy.

Take out a loan

Do you need money for a down payment, or do you want to take out a loan with a low interest rate? Cash value insurance can be a good fit for people who want to avoid the high interest rates associated with bank loans. Although withdrawals could be taxed,

insurance policies have much lower interest rates than most banks,

meaning you’re apt to save some money if you plan on taking out a loan anyway.

When you take out a loan against your policy, you’re borrowing money against the life insurance policy instead of withdrawing money from it, so if you die before paying back the loan, the balance would simply be taken from your death benefit. Just be sure you’ve considered the impact this could have on the value of your life insurance for your beneficiaries before taking the next steps.

Surrender the policy

If you don’t need life insurance anymore, you can

surrender your policy and receive a sum that’s equivalent to the cash surrender value.

Depending on how long your policy was active, you could face some steep surrender fees when canceling, and these fees could be applicable for up to ten or more years into your policy. Since the money you receive as a payout could be taxed as income, this is usually a less popular option.

Pay your premiums with it

Certain types of

cash value insurance

(universal life insurance) allow you to

use your cash value to pay premiums.

Since there are no fees or taxes associated with using the cash value to pay for premiums, this can provide you with financial relief if you were struggling to make the payments for a few months.

Keep in mind that you have to own the policy for at least a year before borrowing from the cash value to pay premiums, and if you deplete funds in the cash value account entirely, it can cause your policy to lapse, therefore ending your life insurance coverage.

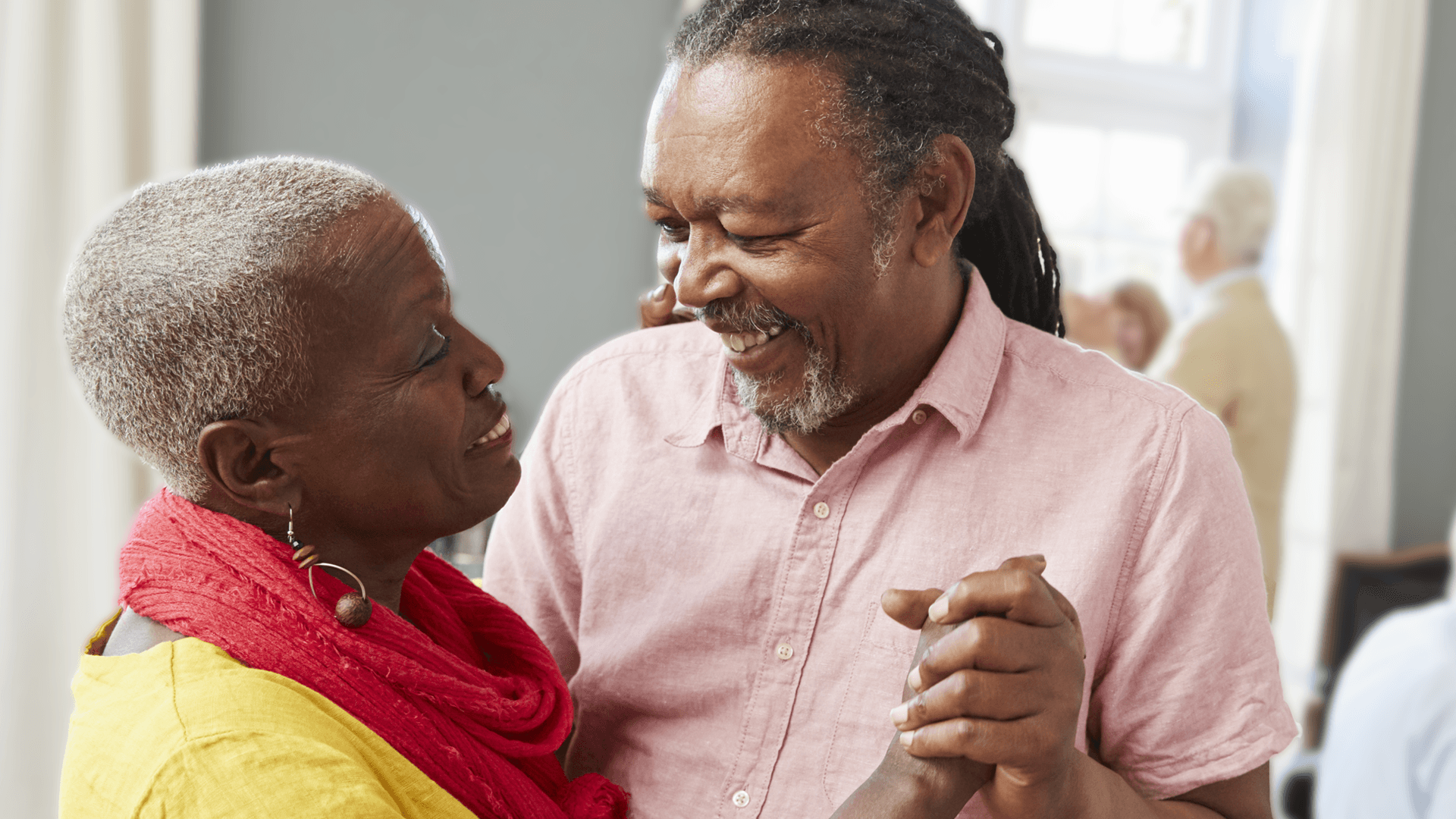

Retiring with cash value insurance

Retiring with a cash value policy has several benefits. To start, the ability to use your cash value to pay premiums can be very helpful when you enter retirement.

Not only are you able to protect your loved ones with life insurance coverage, but you’re also able to use your policy as a savings account, which can be really helpful once you leave the workforce.

During retirement, you’ll have the option to dip into your cash value instead of accessing IRAs or 401Ks. In this case, cash value is another layer of savings that can help you live comfortably in retirement.

Since cash value is only associated with whole and universal life insurance, your life insurance coverage lasts for life. This means that your cash value account continues to grow year after year, all while you’re protected with life insurance.

Get cash value life insurance today!

The ability to pay your premiums with the money in your cash value insurance is a game-changer for anyone who wants to make the most of their life insurance policy during retirement.

By making your money work for you with cash value insurance, you can guarantee lifelong life insurance coverage and the comfort and space to pay for it.

Interested in adding cash value life insurance to your retirement plan? Get in touch with a Symmetry Financial Group agent today by

requesting a quote

for

universal or whole life insurance.

They can help you find the perfect policy, ensuring that the cash value requirements align with your retirement goals.