Most of us buy life insurance with a specific purpose: to cover the expenses that would arise if we were no longer around to support our loved ones. Often,

term life insurance

is the perfect solution for this goal. But what happens if you are still alive when your policy is about to expire? Read on to learn what to do if you outlive your term life insurance.

How term life insurance works

When you buy a term life insurance policy, you choose a term length of 10-30 years. You’ll pay premiums to keep the policy active, and if you die during the term, your loved ones will receive the death benefit. If you don’t die during the term, your policy will expire, and you part ways with the insurance carrier.

As you get older, life insurance premiums generally become more expensive. For this reason, it’s important to choose an optimal term length when you first

buy life insurance

, so you can lock in a low rate when you’re young and healthy. The goal is that you will no longer need life insurance at the end of your policy length, but if you still need life insurance, there are a few strategies for continuing your coverage.

How to decide if you still need coverage

Before your term life insurance expires, you should consider if you still need life insurance. Consider your dependents and who you’d leave behind if you were to die – would they have enough financial support to pay the bills? You should also consider any major life events that might occur in the future: the purchase of a home, paying for your child’s college education, a marriage, a divorce, or the birth of a child. Any of these events could prolong your need for life insurance.

If you decide that you no longer need the support that life insurance offers, you can ride out the rest of your term and let it expire. If you believe that you will need coverage after your term expires, you can either convert your term life policy, renew the term, or purchase a new policy.

Convert your term life policy to permanent insurance or renew the term

If you outlive your term life insurance, you may be able to convert your term life policy to a permanent policy at the end of the term by using a rider. The term conversion rider is often included in a term policy and will allow you to still get coverage if your health has declined over the years. However, some permanent life insurance options can cost more than term life, so you should check with your insurance carrier to determine what your premium would be after conversion.

One advantage of converting to permanent life insurance is that you will have coverage for as long as you are alive, and you will not need a medical exam because your premiums will be based on your health at the time you originally applied for coverage. Additionally, your permanent life insurance might contain a cash value component that you could access during the life of the policy if needed – keep in mind that accessing the cash value can decrease the worth of your policy. Not all term life insurance policies include the option to convert coverage, so be sure to ask your insurance agent if this is a viable option.

You can also renew your coverage term if your carrier offers a renewable term clause in your policy. This allows you to extend your current coverage for a set period without having to requalify for coverage. Renewing your policy is a great option for many people, as future health circumstances are often unknown. The renewable term is reliant on your premium payments being up-to-date. The insurance carrier might also require a renewal premium payment.

Purchase a new life insurance policy

You can also buy a new term life insurance policy and start fresh – this is a good idea for people who are still young and healthy. If you choose to buy a new policy, be sure to begin the process about 6 months before your current policy ends. This will ensure that your new policy is approved and ready to go so you don’t experience a lapse in coverage.

With your new term life policy, you may be able to opt for a

return of premium

feature, which can be a great benefit for younger people who want a longer term length. With return of premium coverage, the insurance company will typically pay back the entire amount of premiums that you paid during the life of the policy at the end of the term, if you do not have to access the death benefit during the term.

If your health has declined since you purchased your current term life policy, then you may not want to purchase a new term policy, as your premiums might dramatically increase based on your health. In this case, your best bet is to convert your term to permanent life insurance, as mentioned above.

The bottom line

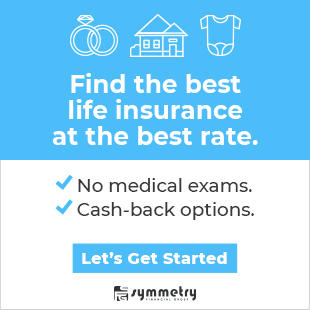

If you still need life insurance coverage when your term life policy is about to expire, we always recommend getting in touch with your Symmetry Financial Group agent. Your agent can create a plan that is the most affordable solution for your budget and lifestyle needs. They can also recommend any riders that you might want to tack on to your policy to ensure you are getting the most out of your coverage.

If you are curious about a term life insurance policy, or you are interested in

getting life insurance

coverage, we are always here to help! Give us a call today at

828-581-0475

.

Please keep in mind that the content of this article does not replace the advice of a licensed insurance agent.